RebelDogs AI Studio

The first global STO-backed AI film studio

Entertainment meets blockchain.

A new era of film financing and revenue sharing.

Why AI Film Studio?

Reduced Costs

Costs reduced 50–70% vs traditional studios

Scalability

more films, faster cycles

Community Driven

Global meme + crypto audience

First Mover Advantage

RebelDogs AI Studio is creating the world’s first decentralized revenue share platform for independent cinema—merging AI innovation, Web3, co-productions, starting with its flagship film, RebelDogs. Read the ScriptBook US Box Office report

Valuation Multiples

| Current Valuation | ||

|---|---|---|

| Trilogy Profit | ~$16M | |

| Valuation Multiple | 7x | |

| Company Valuation | $145M | |

| 4 Year Projection | ||

|---|---|---|

| Cumulative Profit (5 Trilogies) | ~$70M | |

| Future Valuation | $491M+ | |

| Valuation Growth | 444% | |

| Expected Valuation Returns | ||

|---|---|---|

| Private Round Entry | $0.06 | |

| Expected Public Round | $0.50 | |

| Valuation Benchmark | 7–15x EBITDA* | |

*While no outcome is guaranteed, our model demonstrates a potential pathway toward such growth. These projections are hypothetical and not guarantees of future results. Actual performance may differ materially due to risks and uncertainties.

Valuation Growth Projection

Current Valuation

4-Year Projection

Investment Timeline & Returns for early investors

WATCH full movie NOW for Investors only

The Concept

We also acquire and enhance English-language indie films without distribution but with strong global stories. By unifying them under a single brand, leveraging AI voiceovers, dubbing, and viral marketing tools, and strategically reducing marketing costs, we relaunch these films globally on streaming platforms, creating a scalable pipeline of high-quality, widely accessible content.

Trilogy of AI-enhanced feature films

Trilogy of AI-enhanced feature films blending real estate drama, NFTs, meme coins & talking dogs.

Community-powered

Viewers buy access with our native token

Exclusive streaming

After BO, 12 months on our platform before VOD release.

Revenue sharing

Profits distributed annualy to token holders

Why AI Film Studio?

Security Token Offering (STO)

Entry at a 40% discount Security Token Offering (STO) with annual profit distributions count to valuation, with securities subject to a 12-month lock-up.

Profit Sharing

Token Appreciation

Exposure

Financial Model (per film)

Revenue Projection

Box Office: $5 Million–10 Million

VOD: $2.5 Million

Total per film: $5 Million – $12.5 Million

Cost Allocations

10% = Exclusive License Fee (Haege Groep B.V.)

10% = Advertising Budget

10% = Overhead on Production Costs

Remaining = Production, distribution & net profit

Net Profit Estimate

~$3 Million – $5 Million per film

Trilogy Projection

$22.5M – $37.5M

$22.5M – $37.5M 3 Films turnover

$9M – $15M

Net profit trilogy

50%

Distributed to token holders via STO

Token Price $0.05

$0.50 / Token

Expected public round price

1 Billion

Fixed token supply

Key Takeaways

Financial Projections

• $22.5 Million – $37.5 Million turnover per trilogy

• $9 Million – $15 Million trilogy net profit forecast

• 40% Profit Margin

First Mover Advantage

• First AI + STO Film Studio in the market

• Pioneering AI-driven production

• Security Token Offering innovation

First Mover Advantage

• First AI + STO Film Studio in the market

• Pioneering AI-driven production

• Security Token Offering innovation

4-YEAR GROWTH MAP

$491 Million

9x+

4 Years

Investor ROI Scenarios

🔑 Highlights for Investors:

- Immediate bonus tokens = instant upside.

- Public round target = +900% uplift before revenues.

- 9x+ long-term upside when RebelDogs expands to 5 trilogies.

- Quarterly profit-sharing on top of token value growth.

Independent Studios Have Delivered Outsized Returns

A24,Blumhouse, and Legendary all began as niche independents. Each went on to capture global distribution and deliver institutional-scale multiples to early backers:

- A24 → $10 Million seed → $2.5 Billion valuation (250×).

- Blumhouse → $15K budget → $193 Million box office (1,000× ROI).

- Legendary → Independent launch → $3.5 Billion acquisition.

Studio | Early Stage Valuation | Exit Valuation | Multiple for Early Investors |

|---|---|---|---|

A24 | <$10 Million (2012) | $2.5 Billion (2022) | 250×+ |

Blumhouse | <$1 Million per film | $193 Million box office (Paranormal Activity) | 1,000× ROI |

Legendary | Seed-backed indie | $3.5 Billion acquisition (2016) | Institutional-scale |

Rebeldogs AI | First film complete, debt-free | Targeting $150 Million+ valuation by 2029 | First-mover in AI-native filmmaking |

Swipe to read complete table

Proof of Story

Full script & independent book

Independent Projections

Strong IP foundation

Pipeline & Growth Strategy

Rebeldogs AI’s growth is driven by a franchise-based model. Instead of relying on single-title success, the company is producing five trilogies (15 films), each designed to build audience loyalty and compounding value.

2026 Q2

RebelDogs I Release

2026 Q4

RebelDogs II

2027 Q4

RebelDogs III

2027+

Expansion into 5 trilogies (15 films), spin-offs & streaming platform

Financial Upside

Tranche 1 Investors

Tranche 2 Investors

Entry at a 30% discount to valuation, also subject to lock-up.

Dividend distributions

Potential liquidity

Key Milestones

Why Invest in Rebeldogs AI Now

3× Faster, 3× Cheaper

First Film Complete & Debt-Free

Global Distribution Secured

Independent Revenue Validation

Early Investor Advantage

Financial Upside

Rebeldogs AI provides a differentiated, institutionally structured entry point into a traditionally inefficient asset class

First-Mover Advantage

The world’s first AI-native film studio, positioning as a category leader.

Risk-Adjusted Entry

Initial feature film already completed and distributed; investors step in with execution risk substantially reduced.

Attractive Pricing

40% and 30% early-round discounts against a $110 Million valuation basis.

Governance & Control

Delaware legal framework, structured shareholder protections, and codified dividend policy.

Liquidity Path

Post lock-up, securities are transferable through DigiShares’ regulated secondary market, providing a potential path to liquidity.

Scalability

Multi-film pipeline ensures repeatability, compounding revenues, and franchise-style upside.

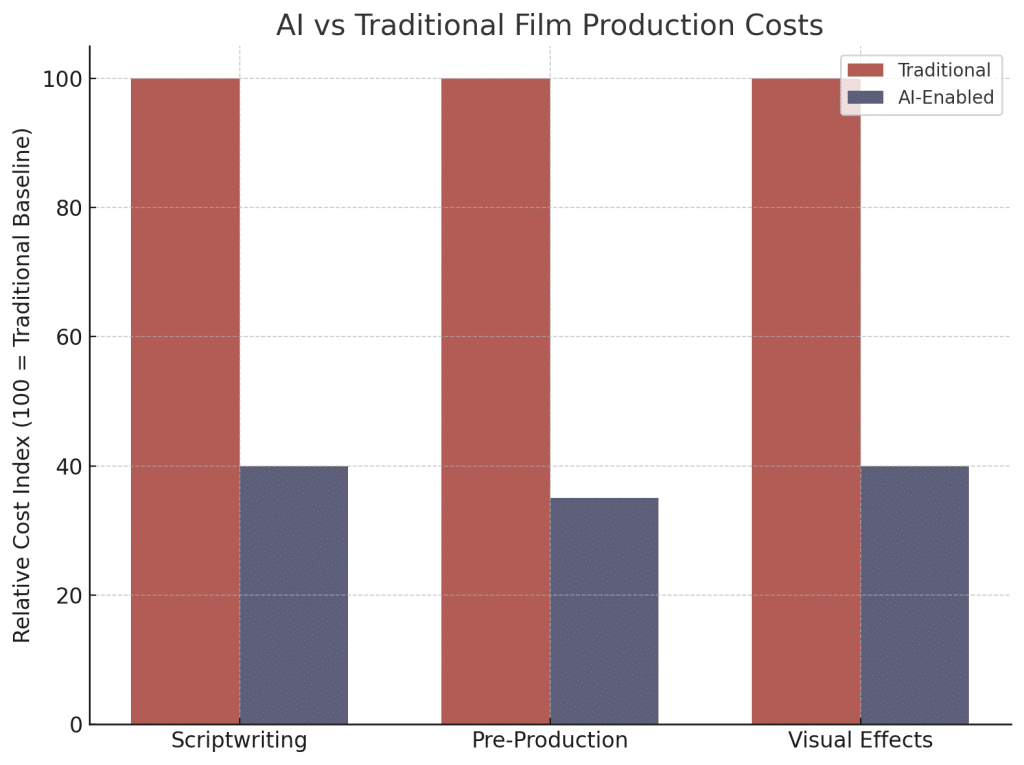

AI Slashes Film Production Costs

By embedding AI into scriptwriting, pre-production, and VFX pipelines, Rebeldogs AI reduces costs by 60% or more across the most resource-heavy stages of filmmaking — while maintaining cinematic quality.

Institutional Structure & Governance

Haege Groep B.V. (Netherlands)

IP holding entity retaining all rights and revenues.

Budget Management S.L. (Spain)

Production entity with a fixed 10% fee, ensuring cost discipline and delivery.

Rebeldogs AI Studio Inc. (Delaware, USA)

Fundraising vehicle enabling SEC-compliant U.S. capital raising under Reg D 506(c).

Governance

All securities are issued and managed via the DigiShares platform, providing digital cap table management, KYC/AML compliance, and regulated secondary transferability post lock-up.

Finance Executive Leading the Numbers

Leadership & Advisors

Morgan Grunefeld

Leadership & Advisors

Rebeldogs AI is building more than films — it is building an AI-powered studio model designed for institutional capital. With proof of execution, structured governance, and a scalable franchise pipeline, this offering provides a rare opportunity to participate at the foundation stage of a category-defining enterprise. With proof of execution, structured governance, and a scalable franchise pipeline, this offering provides a rare opportunity to participate at the foundation stage of a category-defining enterprise.

WATCH full movie NOW for Investors only

FAQ

This private placement is worldwide but in the U.S. for accredited investors under U.S. Regulation D, Rule 506(c). All investors must complete KYC/AML verification through the DigiShares platform before subscribing.

Investors receive digital securities (security tokens) issued by Rebeldogs AI Studio Inc. (Delaware C-Corp). These represent equity interests in the company and are recorded on the DigiShares platform.

Yes. Securities issued in this private round are subject to a 12-month lock-up period. After the lock-up expires, transfers may only be conducted through DigiShares’ regulated secondary market, subject to compliance checks.

While no returns are guaranteed, Rebeldogs 1 has been independently forecasted to generate ~$10 Million in revenue. Based on the company’s valuation methodology and discounted entry pricing, investors benefit from both profit participation and potential capital appreciation across the 15-film pipeline.

100% of proceeds from this $5 Million raise are allocated to the production of Rebeldogs 2 and 3, both already in pre-production.

Shareholders benefit from institutional safeguards including:

• Dividend policy codified in Delaware law.

• Tag-along and drag-along rights.

• Structured lock-up and transfer restrictions.

• Independent production agreements to control costs.